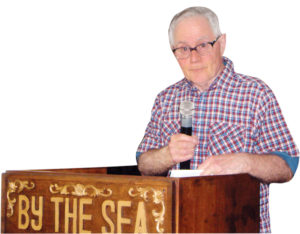

Fr Sean Connaughton gives thanks for the Grameen banking system which operates on the belief that most of its poor borrowers can be trusted to repay their small loans.

The Grameen Bank was founded in 1970 by Professor Muhammad Yunus, a former professor of economics at Chittagong University in Bangladesh, as a response to the grinding poverty he witnessed which left so many families eking out an existence. He believed that banking needed to rediscover the true meaning of ‘credit’ which is ‘trust’. In his book, ‘Banker of the Poor’, Professor Yunus highlights how over the years, as commercial banking has become institutionalised, it has built its entire edifice on the basis of mutual distrust.

In Professor Yunus’ philosophy, everyone has the right to credit. Accepting the Nobel Prize for Economics in 2006, he said, “I believe that we can create a poverty-free world because poverty is not created by poor people. It has been created and sustained by the economic and social system that we have designed for ourselves: the institutions and concepts that make up that system; the policies that we pursue.”

Grameen Bank provides microloan programmes to low income and poor families who would ordinarily be spurned by the commercial banks and other financial institutions. Loans offered by Grameen are intended to finance income generating projects and businesses of its members.

The bank is based on the voluntary formation of groups of five people who provide binding group guarantees instead of collateral required by conventional banks. Initially, only two members of the group can apply for a loan. Depending on their repayment performance, the next two borrowers are allowed to apply followed by the fifth member. Most of the loans are very small, but just a few dollars can go a long way to easing the debt burdens and poverty of the poor. Through careful supervision and management, repayment rates are well over 90%.

The bank is based on the voluntary formation of groups of five people who provide binding group guarantees instead of collateral required by conventional banks. Initially, only two members of the group can apply for a loan. Depending on their repayment performance, the next two borrowers are allowed to apply followed by the fifth member. Most of the loans are very small, but just a few dollars can go a long way to easing the debt burdens and poverty of the poor. Through careful supervision and management, repayment rates are well over 90%.

In 1991, Kazama Grameen was founded at Sta. Rita, Olongapo City in the Philippines by Columban missionary Fr Sean Connaughton. A year after setting it up in Olongapo City, the bank branched out to Candelaria, Zambales with the help of a parish Basic Ecclesiastical Community (BEC) known as Sambayanang Kristiyano.

By the time Fr Sean reached the age of 70 in 2004 and decided to return to Ireland to take on some pastoral duties, there were about 17,000 small businesses functioning with the help of the Kazama Grameen Bank along the 400-kilometre stretch north of Manila. Modern technology has enabled Fr Sean to continue to play a part as an external auditor from his base in Ireland.

According to Fr Shay Cullen, trusting the poor pays in lending. In his view, the Grameen concept of microcredit is the “most effective and empowering financial system to help the poor overcome crushing and devastating poverty”. When he set up the Preda Human Development Centre in the Philippines, Fr Cullen turned to Grameen bank to help the villagers around Subic Bay and throughout Zambales. In a tribute, Fr Cullen said Fr Sean had established a “well managed and disciplined Grameen micro-finance loan project that has helped thousands escape poverty”.

According to Fr Shay Cullen, trusting the poor pays in lending. In his view, the Grameen concept of microcredit is the “most effective and empowering financial system to help the poor overcome crushing and devastating poverty”. When he set up the Preda Human Development Centre in the Philippines, Fr Cullen turned to Grameen bank to help the villagers around Subic Bay and throughout Zambales. In a tribute, Fr Cullen said Fr Sean had established a “well managed and disciplined Grameen micro-finance loan project that has helped thousands escape poverty”.

For example, remote villages had no stores and families had to cross the bay in their flimsy boats or traverse the mountain to get salt, cooking oil, garlic and other basic needs to repair their fishing boats or get other necessary items. Mostly, they had to borrow from loan sharks at usurious rates that crippled them and drove them into even greater poverty and despair.

When Fr Connaughton brought in the Grameen loan system most of the women set up small businesses that served the community. One woman became the supplier of salt and oil, another brought a sewing machine and made clothes for the village and another became the maker of brooms. Another set up a fishing supply business. All of these were based in their own homes.

Angelina’s story

Angelina’s story

I became a member of Grameen in 1993. My first loan was 1,500 pesos (c.€25) to be paid back in 12 months. With that I was able to sell fried bananas every day. After that I got 3,000 pesos and bought a sewing machine. This was a huge investment for me but it made a big difference to the family. When my son Bong was old enough, we got a loan to buy a welding machine that cost 12,000 pesos. In 1999 we borrowed 10,000 pesos to buy the pots and pans and all the rest to set up a catering service, while Bong continued as a welder. My most recent loan was for 50,000 pesos and I repay 2,500 pesos every week. I have been elected president of the local centre (25-30 Grameen members) on a few occasions. I have been strict with my weekly repayments. If not, those on the waiting list would not be able to get their loans. My children are now finished college and although my husband died recently, the family earns a good livelihood.

Grameen supporter in UK

Grameen supporter in UK

90-year-old Mary has been a Grameen supporter since 1997. She recently sent £60, which will buy a second hand sewing machine or a small pig for someone. She explained to Fr Sean how she raised the money:

Dear Fr Sean,

I have sent Fr Peter £60 and asked him to send it to you for the Philippines. My late husband bought me a lovely handbag but it got little use. I felt guilty about it. My granddaughter has a shop on Ebay, so I asked her to sell it saying the money was to go to the Columban Fathers. She said she got a very good response – it raised £60 so I am very happy. I know there will be some little ones you can help.

If you would like to support Fr Sean Connaughton’s Grameen project in the Philippines with a donation, please click here for our donations page. Thank you!